Investors Earn 304% Returns on SGB Premature Redemption – RBI Announces Final Redemption Price

RBI announces premature redemption of Sovereign Gold Bond (SGB) 2018–19 Series-II. Investors can now earn a whopping 304% return. Check redemption process, interest benefits, and key factors influencing SGB returns.

Investors in the Sovereign Gold Bond (SGB) 2018–19 Series-II have received an incredible opportunity to earn 304% returns through premature redemption, as announced by the Reserve Bank of India (RBI) in October 2025. This announcement has created significant buzz among investors seeking secure yet high-return investment avenues in India.

SGBs have consistently been one of the most effective ways to invest in gold without the risks and storage hassles associated with physical gold. With government backing, fixed interest, and tax benefits, SGBs are increasingly attracting both seasoned investors and first-time gold investors.

In this blog, we will break down the details of this phenomenal 304% return, explain how premature redemption works, explore historical performance, and guide investors on how to leverage SGBs for long-term wealth creation.

What Are Sovereign Gold Bonds (SGBs)?

Sovereign Gold Bonds are government securities denominated in grams of gold, issued by the Reserve Bank of India on behalf of the Government of India. They provide an innovative way for investors to gain exposure to gold without physically holding it.

Key Features of SGBs

- Denomination & Purchase Limit:

SGBs are available in 1-gram denominations, with a maximum investment limit of 4 kg per financial year for individuals and 20 kg for entities such as trusts or companies. - Fixed Interest:

Investors earn a 2.5% annual interest, payable semi-annually, over the tenure of the bond. - Capital Appreciation:

The redemption price of SGBs is linked to the prevailing market price of gold, allowing investors to benefit from gold price appreciation. - Tax Benefits:

The capital gains on redemption of SGBs are exempt from tax, making them more attractive than physical gold. Interest income, however, is taxable. - Premature Redemption Option:

SGBs can be redeemed prematurely after completing 5 years from the date of issuance, typically on the interest payment dates.

SGBs provide a blend of income, capital appreciation, and tax efficiency, making them a standout investment compared to physical gold or gold ETFs.

How Investors Achieved 304% Returns

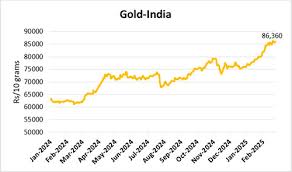

The SGB 2018–19 Series-II was issued on October 23, 2018, at a price of ₹3,287 per gram. The RBI announced the premature redemption price on October 23, 2025, as ₹12,704 per gram, based on the average closing price of gold of 999 purity over the previous three working days.

Calculating the Return

- Issue Price: ₹3,287 per gram

- Redemption Price: ₹12,704 per gram

- Absolute Capital Gain: ₹12,704 – ₹3,287 = ₹9,417 per gram

- Percentage Gain: (₹9,417 / ₹3,287) × 100 = 287%

When you include the semi-annual interest of 2.5% per annum, the total return reaches approximately 304%, making it one of the highest returns in Indian investment history for a government-backed product.

Premature Redemption Process

Investors who wish to redeem their SGBs before maturity should follow these steps:

- Check Eligibility:

Ensure that the bond has completed at least 5 years from the date of issuance. - Redemption Dates:

Submit a request for redemption on the interest payment dates announced by RBI. - Submission Process:

Approach the bank, post office, or authorized agent where the SGB was originally purchased. - Documentation:

Provide ID proof and bond details as required. - Processing Time:

Premature redemption is usually credited to your linked bank account within a few working days after RBI confirms the redemption price.

Tip for Investors: Submit the redemption request well in advance to avoid last-minute delays and ensure smooth processing.

Historical Performance of SGBs

SGBs have consistently delivered impressive returns for investors who held them over medium to long-term periods. Here’s a comparative view:

| SGB Series | Issue Price (₹/gm) | Redemption Price (₹/gm) | Return % |

| 2017–18 Series III | 2,866 | 12,567 | 338% |

| 2017–18 Series IV | 2,971 | 12,704 | 325% |

| 2018–19 Series II | 3,287 | 12,704 | 304% |

| 2020–21 Series VII | 5,051 | 12,792 | 153% |

Observation: Earlier series had higher returns due to lower issue prices combined with a strong surge in gold prices.

Factors Influencing SGB Returns

The returns on SGBs are influenced by multiple factors:

1. Gold Price Fluctuations

The primary determinant of returns is the movement in gold prices. A sustained increase in global and domestic gold prices leads to higher redemption values.

2. Fixed Interest Payments

The 2.5% semi-annual interest supplements capital gains, improving the overall returns for investors.

3. Investment Duration

Longer holding periods generally result in greater capital appreciation, especially during periods of rising gold prices.

4. Market Conditions

Global events, inflation, currency fluctuations, and geopolitical tensions can significantly impact gold prices, and thus SGB returns.

5. Economic & Policy Factors

RBI policies, interest rate movements, and government fiscal measures can indirectly influence gold demand and SGB performance.

Comparing SGBs with Other Gold Investment Options

Many investors wonder whether to invest in physical gold, gold ETFs, or SGBs. Here’s how SGBs stand out:

| Feature | Physical Gold | Gold ETFs | SGBs |

| Storage Risk | High | Low | None |

| Interest Income | None | None | 2.5% p.a. |

| Capital Gains Tax | Yes | Yes | Exempt |

| Liquidity | Moderate | High | Moderate, can redeem after 5 years |

| Safety | Risk of theft | Secure | Government-backed |

Conclusion: SGBs offer the safest, tax-efficient, and interest-bearing route to invest in gold.

Who Should Invest in SGBs?

SGBs are ideal for investors who:

- Want safe exposure to gold without holding physical assets.

- Are seeking long-term capital appreciation.

- Prefer tax efficiency with government-backed securities.

- Are ready to lock in their investment for 5–8 years.

- Want regular interest income along with price appreciation.

Conclusion

The 304% return on SGB 2018–19 Series-II highlights why Sovereign Gold Bonds remain one of India’s most rewarding investment options. Combining capital appreciation, fixed interest, and tax benefits, SGBs provide an excellent alternative to physical gold and gold ETFs.

Investors planning to invest in gold should consider SGBs for long-term wealth creation, while carefully following the RBI’s redemption guidelines. Historical data shows that SGBs consistently outperform traditional gold investments over medium to long-term periods, making them a smart choice for both conservative and growth-oriented investors.

FAQs

1. What are SGBs?

SGBs are government securities linked to gold prices, providing returns through capital gains and fixed interest.

2. How is the redemption price calculated?

Based on the average closing price of 999 purity gold over the previous three working days, as published by IBJA.

3. Can I redeem SGBs before maturity?

Yes, after completing 5 years from the date of issuance, on the RBI-specified interest payment dates.

4. Are SGB returns taxable?

Capital gains are exempt from tax, while interest income is taxable under ‘Income from Other Sources’.

5. How do I invest in SGBs?

SGBs can be purchased via authorized banks, post offices, and brokers during the subscription period announced by RBI.

For More Such Amazing Content Please Visit : https://investrupeya.insightsphere.in/

Post Comment