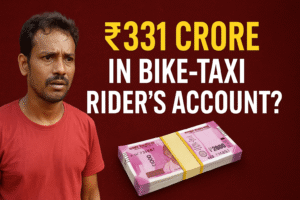

₹331 Crore in a Bike-Taxi Rider’s Account: The Shocking Reality Behind India’s Most Bizarre Money-Laundering Case

When news broke that over ₹331 crore had been routed through the bank account of a bike-taxi rider living in a tiny two-room house in Delhi, India was stunned. The figure was unbelievable, the circumstances bizarre, and the implications chilling. Overnight, the “331 crore bike taxi rider case” became one of the most talked-about investigations in the country — raising deep questions about money laundering networks, mule bank accounts, illegal betting syndicates, and the vulnerability of India’s gig-economy workforce.

This blog presents the entire 331-crore bike-taxi rider account case in detail, breaking down the money trail, suspected culprits, ED investigation, links to a luxury wedding, and the huge loopholes in India’s digital financial ecosystem.

If you want a complete, authoritative, SEO-friendly, deeply researched explanation, this is it.

⭐ INTRODUCTION: A Small House, A Big Number

The story begins when the Enforcement Directorate (ED), while investigating an illegal betting network, stumbled upon a bank account with inflows and outflows exceeding ₹331.36 crore between August 2024 and April 2025.

Nothing unusual so far — until investigators visited the account holder’s address.

The supposed “beneficiary” was:

- a bike-taxi rider,

- living in a small, modest home,

- working to make ends meet,

- with zero knowledge of how such a colossal sum entered his account.

This wasn’t a millionaire.

This wasn’t a businessman.

This wasn’t a politician.

This was an ordinary gig-economy worker.

So how did ₹331 crore end up in his account?

The ED immediately suspected that the account was used as a “mule account” — a common technique in money laundering where criminals route illicit funds through unsuspecting or vulnerable individuals.

But when the ED began tracing the money, the story got even stranger.

⭐ CHAPTER 1: WHAT EXACTLY IS A MULE ACCOUNT?

To understand the 331 crore rider account case, you must understand concepts like:

✔️ Mule Account

A mule account is a bank account used by fraudsters to:

- store laundered money,

- route transactions to hide the source,

- operate illegal businesses like betting networks,

- or funnel money for political or organized crime.

Mules can be:

- real people (tricked or bribed),

- identity theft victims,

- or even fake identities created using forged documents.

In this case, ED believes the rider was:

➡️ a genuine person,

➡️ who had no idea his account was being used,

➡️ whose KYC documents were exploited,

➡️ whose financial identity was used as a front.

This practice is common in illegal betting syndicates, especially those linked to international platforms like 1xBet.

⭐ CHAPTER 2: HOW ₹331 CRORE MOVED THROUGH A DRIVER’S ACCOUNT

The most astonishing detail was not the total sum — but the pattern.

🔹 Timeline of the Transactions

- Transactions occurred between 19 August 2024 – 16 April 2025

- Over hundreds of small transfers, often under scrutiny thresholds

- Money was both credited and debited at high volumes

- ED found rapid movement from account to account, suggesting:

- circular trading

- layering (a money-laundering stage)

- avoidance of detection

🔹 Purpose of Money Laundering Movement

ED suspects the funds were linked to:

- illegal betting

- hawala transfers

- crypto settlement networks

- political funding

- a luxury wedding (more on that soon)

⭐ CHAPTER 3: THE UDAIPUR LUXURY WEDDING — WHERE THE MONEY WENT

One of the most sensational revelations came when investigators traced part of the ₹331 crore to a lavish destination wedding in Udaipur.

🎉 A Wedding Fit for Royalty

The event included:

- premium 5-star resort bookings

- massive flower decorations

- high-end catering

- performances

- luxury logistics

- VIP guests

According to ED’s findings:

- Over ₹1 crore directly from the rider’s “mule account” funded the wedding

- The groom’s family declared no source for such lavish spending

- Money trail connected the wedding expenditure to a network under ED’s scanner

🔥 Political Links?

Media reports also mentioned ED probing links to:

- a Gujarat-based political figure,

- contractors,

- and event managers.

This triggered nationwide media interest, making the “331 crore bike taxi rider case” a major national headline.

⭐ CHAPTER 4: WHO IS THE RIDER? WHAT DID HE SAY?

When ED arrived at the registered address, the man was:

- shocked

- terrified

- confused

- and unaware of how his account became a money highway.

His statements included:

“I don’t know anything about these transactions.”

“I am just a rider. I earn a small amount daily.”

“I did not authorize any large deposits.”

“I use my bank only for salary credit.”

✔️ ED Conclusions:

- He was likely not the mastermind

- His identity/KYC was possibly misused

- The account might have been created or controlled by others

- He may have been a victim of a scam

- OR he unknowingly signed papers in exchange for money

Gig-economy workers, especially delivery agents and bike-taxi riders, often sign documents without fully understanding consequences — a vulnerability exploited by criminal networks.

⭐ CHAPTER 5: HOW CRIMINAL NETWORKs USE GIG-WORKER ACCOUNTS

The “331 crore rider account case” has exposed a massive structural weakness in India’s financial environment.

Criminal networks often target:

- delivery boys

- drivers

- migrant labourers

- unemployed youth

- people needing instant cash

Why?

Because they are:

- financially vulnerable

- less aware of cyber/financial laws

- easily influenced

- looking for quick earning opportunities

Possible exploitation methods:

- Offering money to “rent out” bank accounts

- Misusing digital KYC

- Using forged documents

- Opening accounts on their behalf

- Taking control of ATM cards, SIM cards and passwords

The “331 crore rider case” highlights that this is not an isolated event — but a systemic criminal strategy.

⭐ CHAPTER 6: THE ILLEGAL BETTING NETWORK BACKGROUND

The ED believes the money was linked to an international betting syndicate, especially around:

➡️ 1xBet and linked platforms

➡️ fraud gambling operations

➡️ crypto wallets used for settlements

These networks often:

- accept illegal bets from India,

- route funds through multiple bank accounts,

- use small account holders to bypass AML (Anti-Money Laundering) flags,

- settle money via hawala and crypto.

The 331 crore case fits this pattern perfectly.

⭐ CHAPTER 7: WHY DID THE ED GET INVOLVED?

The Enforcement Directorate got involved due to:

✔️ Illegal foreign betting operations

Betting syndicates are illegal in India but operate internationally.

✔️ Suspicious transaction reports (STR) from banks

Banks flagged abnormal activity.

✔️ Money Laundering Prevention Act (PMLA) violations

Routing such money through mule accounts is a federal offense.

✔️ Political funding concerns

Part of the trail linked to high-profile individuals raised the stakes.

⭐ CHAPTER 8: KEY FINDINGS OF THE ED (AS PER AVAILABLE REPORTS)

- Total amount routed: ₹331.36 crore

- Time window: 19 Aug 2024 – 16 Apr 2025

- Rider unaware of the transactions

- Used as a mule account

- Links to illegal betting networks

- Funds used in a luxury Udaipur wedding

- Possible political links under scrutiny

- Multiple accounts involved across states

- Layering done through dozens of small transactions

- Identity forgery suspected in some linked accounts

⭐ CHAPTER 9: IMPLICATIONS FOR INDIA’S GIG ECONOMY

The 331 crore bike taxi rider account incident exposes a dark reality:

Gig-workers are easy targets for:

- money launderers

- fraud networks

- identity thieves

- cyber criminals

- betting syndicates

Why?

Because they:

- are financially vulnerable

- lack legal awareness

- often share documents easily

- use inexpensive smartphones

- cannot detect identity theft

- fall prey to “easy money” traps

This case should serve as a wake-up call for platforms like:

- Rapido

- Zomato

- Swiggy

- Uber

- Ola

and policymakers.

⭐ CHAPTER 10: THE LOOPHOLES THAT ENABLED THE 331 CRORE SCAM

1. Weak Digital KYC Process

KYC verification is still vulnerable to manipulation.

2. Easy opening of online bank accounts

Online onboarding often lacks deeper scrutiny.

3. No monitoring of volume anomalies

Huge transactions through small-income accounts should trigger earlier alarms.

4. Lack of awareness among gig-workers

They sign documents without understanding risks.

5. Weak enforcement on illegal betting platforms

International betting sites still operate freely through VPNs and crypto.

⭐ CHAPTER 11: WHAT MUST BE DONE NOW?

✔️ Stronger gig-worker awareness programs

Platforms must educate workers about scam risks.

✔️ Strict bank profiling

Accounts of low-income individuals must be monitored for anomalies.

✔️ Crackdown on illegal betting platforms

International betting apps must be blocked more effectively.

✔️ Mandatory financial literacy

Gig workers must be taught basics of:

- identity fraud

- bank safety

- money laundering risks

✔️ Stronger KYC guidelines

India needs biometric and behavioural verification.

⭐ CONCLUSION: A CASE THAT SHOCKED THE NATION

The 331 crore bike-taxi rider account case is more than a sensational headline — it is a mirror reflecting:

- India’s financial vulnerabilities,

- digital loopholes,

- unchecked betting networks,

- misuse of gig-economy workers,

- and the deep reach of money-laundering syndicates.

This case will go down as one of the most extraordinary financial fraud stories in recent years, not because of the amount — but because of the identity of the person whose account it passed through.

A man who spent his days riding a bike to earn a few hundred rupees…

unknowingly became the face of a ₹331 crore money-laundering scandal.

The investigation is still ongoing.

More revelations may emerge.

And India must prepare for deeper reforms.

For More Such Amazing Content Please Visit : https://investrupeya.insightsphere.in/

Post Comment